BiggerPockets.com, a highly regarded site for real estate investors, recently spotlighted the solutions Riaz Capital is providing to solve California's housing crisis. This article features Riaz Taplin's singular focus of delivering thoughtfully designed apartments at approachable price points to historically underserved markets. Read more to learn about how Riaz Capital's business model has overcome lending and municipal challenges to create a "win-win" for investors, landlords, and tenants.

It is no secret that the Oakland rental market is struggling on both the demand and supply sides: a glut of new deliveries is hitting the market while local crime and inaction from City leaders are causing businesses and citizens alike to pack up and leave town. Many struggling multifamily housing operators are quickly learning that the asset management status quo of the past will simply not work in the current environment.

Climate change is among the most dangerous threats facing humanity and future generations, and time is running out. In August 2022, the federal government passed the Inflation Reduction Act (IRA) as a tool to meet the United States’ obligations to lower global emissions and fight climate change.

The Inflation Reduction Act (IRA), a truncated version of the original Build Back Better legislation, is an unprecedented federal investment in mitigating the effects of climate change. The bill earmarks $369 billion for energy efficiency upgrades, controls on greenhouse gas (GHG) emissions,

The housing crisis in California reached its height in 2019, when the state was 3-4 million units short. For perspective, that was equivalent to 20-30% of the existing stock,

For a moment last year, the Federal Reserve’s fight against inflation seemed like a success. Inflation rates came down, consumers pulled back, and unemployment didn’t jump.

With a keen eye for design and a profound appreciation of the uplifting effect that art has on communities, principal and founder Riaz Taplin began the Riaz Capital Arts Program.

In the spring of 2015 Russ Taplin, one of the founders of Riaz Capital, was talking to the owner of a gas station near one of the firm’s apartment buildings in Oakland, California.

Urmila is a 7th grader at the Sevaron-ki-Dhani Government Upper Primary School in the state of Rajasthan in India. Like many children in rural India, she is the first person in her family to get a formal education, and she dreams of having a career one day.

Back at South Broward High School, Rachelly Buzzi was once nominated by her classmates as most likely to be President someday.

Two of the biggest challenges we face — not just in the Bay Area, but nationwide — are wealth inequality and climate change.

Mirna and Oscar fled poverty and violence in Guatemala several years ago with the hope of making better lives for themselves in the United States.

Gustavo Ontiveros, now 24, discovered his passion growing up in Salinas, California. As an earnest and affable young man with a facility for mathematics, one of his high school teachers asked him to help tutor his fellow students in math.

The Bay Area’s supply of new housing is often likened to a barbell: On one end is a significant quantity of subsidised affordable housing and on the other, a plentiful supply of upscale housing that many cannot afford

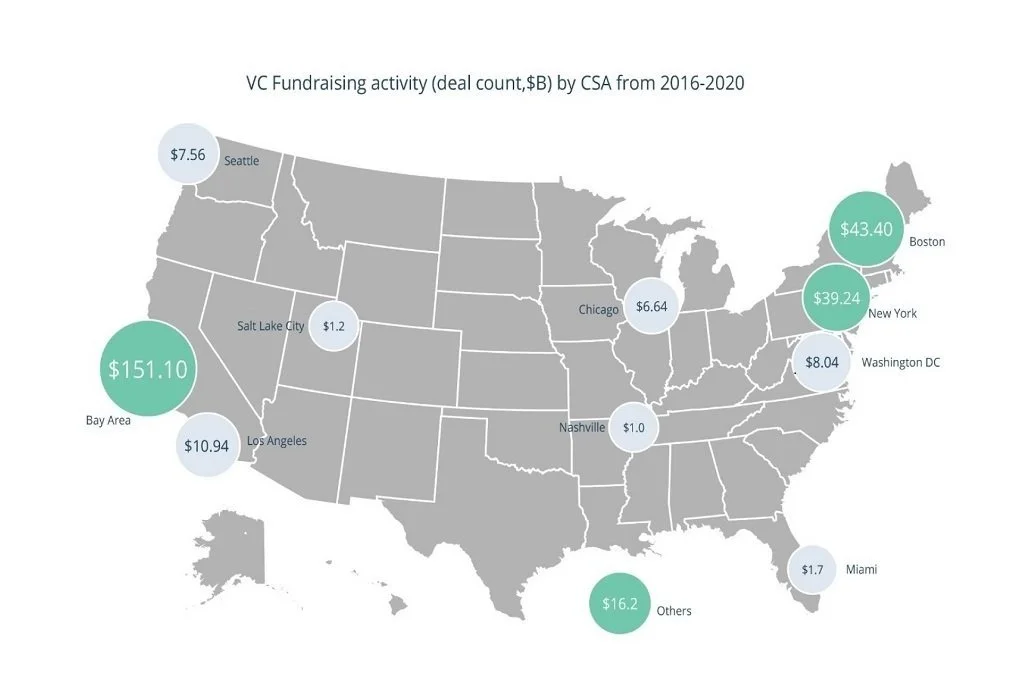

With record amounts of venture capital funding flowing into the region, employees returning to urban offices, and students coming back to the classroom, the Bay Area shows signs of continued high demand for multifamily housing.

Maika is an 11-year old artist living with severe aplastic anemia. She wished to create a public mural – showcasing her artwork and creativity to inspire others in our community.

One prominent rental property in San Francisco boasts 30,000 square feet of amenities, including three landscaped outdoor terraces, two different solariums, a fitness center, a “pet spaw,” and mailroom with cold storage for perishable deliveries.

The casual observer may be baffled by the idea of people choosing to live in only 400 square feet.

Even before the COVID-19 pandemic, 1/3 of U.S. households were “doubled up”, containing an extra adult other than the householder.

The Bay Area has failed to meet the housing needs of its growing population, leading to absurd housing costs across the region.