Contra Costa

1460 Contra Costa

Held

Profit

We purchased this off-market property with rents set at 60% of nearby institutional comparables. With extensive building repurposing and aesthetic upgrades, the rental rates beat those of local comparable properties with a basis of ~$13M.

Eastwood

1715 High St.

Held

Profit

1715 High Street is a 33 unit apartment building in Oakland's Fremont. After executing unit upgrades, common area modernization, and building infrastructure improvements, we sold the building in 2016.

2000 Linden

2000 Linden Street

Held

Profit

We purchased this property in West Oakland for $1.6M in October 2013. After implementing unit and common area upgrades, we sold this property off-market in April 2022 for $5.2M.

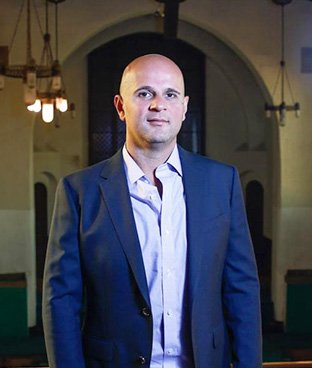

Rose on Bond

1638 47th Ave.

The Rose on Bond project renovated an existing church and adjacent building, converting it into 60 rental apartments consisting of studios, 1 bedrooms, and 2 bedrooms. We acquired the land on which this historic building stood for $1.8M and performed an extensive restoration valued at $13.4M that upgraded the interiors for modern living while maintaining its unique aesthetic. Now restored to its original beauty, this iconic building bridges the gap between the classic Spanish Revival style and elements of 21st century interior design.

Artthaus Grand

220 Grand Ave Oakland, CA

After purchasing the property in 2019 for $3.9M, we completed a 20-month, $6.5M renovation that retained only the shell of the building while modernizing everything else. The result was an expansion in unit count from 8 to 11 (which created a total of 33 rentable suites), thorough upgrades to the units and common areas, and significant aesthetic improvements to the exterior. The property now offers a mix of furnished and unfurnished suites with private kitchenettes, built-in storage, and natural lighting, as well as a community kitchen, package concierge, bike storage, smart locks, and a virtual doorman.

Oakbrook Manor

1232 E 19th St Oakland, CA

When we first encountered Oakbrook Manor, the property was poorly managed, struggling with a 63% occupancy rate. We purchased it at $44M - a ~$9M discount to its pre-Covid value - because it had strong fundamentals, ADU potential, and a stellar location near Lake Merritt. We upgraded both interiors and exteriors, including fresh paint and new electrical systems, added a fitness center, and converted 34 unused garages into 17 well-appointed studios (ADUs). Our value-creation process including densification resulted in a lift of 125 basis points or ~50% increase to project-level NOI over the development period.

Waterstone Terrace

522 1/2 W K St, Benicia, CA

Waterstone Terrace is a 60 unit, 6 building apartment complex located in Benicia, California - a quiet coastal town in the North Bay region of San Francisco. Since acquisition in 2017 for $11.9M, the property has undergone unit upgrades to reflect a more modern look and extensive exterior improvements for a refreshing "park" environment for our residents.

Magnolia Terrace

319 Tabor Ave, Fairfield, CA

The Fairfield portfolio consists of 3 adjacent apartment complexes - Redwood Hills, PineGrove Apartments, and Magnolia Terrace - located in Fairfield, California. Initially, we acquired Redwood and Magnolia in 2017 for $12.2M. Through improvements to the units and common areas, we achieved enough rent growth at the two buildings allowing us to refinance in 2018 and acquire PineGrove at no additional cost. The three buildings are identical in structure with a large courtyard in the middle of the complex - including a pool in each.