VALUE-ADD OPPORTUNITIES UNDER CALIFORNIA’S NEW DENSIFICATION LAWS

May 21, 2023

At nearly 6%, California’s housing deficit was the second-highest in the nation as of 2020, making California 49th out of 50 states for housing units per capita. Though some progress has been made since then, demand still outpaces supply as California’s economy continues to grow and add new jobs. The current housing shortage is 1-2 million units , depending on the metric.

Until recently, the housing supply (in areas of economic opportunity) was suppressed by antiquated local zoning restrictions throughout California. Now, thanks to a slew of new legislation at the State level, developers can finally work around local restrictions to get the permits they need to build more housing. The State’s overruling of local legislation is in recognition of the urgent need for accessibly-priced housing and the unfairness of local laws that often favor NIMBYism over positive social and economic impact.

The State ADU Law - More Granny Flats and In-Law Units

One of the most cost-effective ways to increase housing inventory is by adding Accessory Dwelling Units (ADUs) to existing properties. Under Assembly Bill 2221 and Senate Bill 897, which took effect this year to clean up the State ADU Law, ADUs — sometimes called “granny flats” or “in-law units” — can now be added to multifamily dwellings in spaces such as storage rooms and carports.

A Deep Dive into the New Legislation

Impact on Parking

If ADU residences are created by converting spaces originally meant for car parking (whether carports, garages, or parking structures), local agencies can no longer require more off-street parking to replace the loss of parking spaces. This dovetails with the State’s general relaxation of parking requirements: local agencies are now prohibited from imposing minimum parking requirements within a half-mile walking distance of public transit, according to AB 2097, another new piece of housing legislation.

Loosening Restrictions on ADU Construction

In the absence of convertible structures like carports, AB 2221 stipulates that two ground-up detached ADUs can be built on most residential properties, including multifamily properties.

Local agencies can no longer restrict ADUs to less than 850 sq. ft. (or 1,000 sq. ft. if an ADU has more than one bedroom).

Impact fees must be waived for ADUs up to 750 sq. ft. If an ADU is 750 sq. ft. or more, local agencies can still charge impact fees but they have to be proportional (by square footage) to the impact fees for the primary dwelling unit(s).

SB 897 increases the height limit — from 16 ft. to 18 ft. — for detached two-story ADU structures on multifamily properties that are within half-mile walking distance of a major transit stop or high-quality transit corridor (plus another 2 ft. to accommodate ADU roof pitches otherwise in line with roof pitches of the primary dwelling units). An attached ADU can now be 25 ft. or as high as the primary dwelling unit, though local agencies can still limit ADUs to two stories.

AB 2221 and SB 897 also eliminate the front setback limits for ADUs and reduce setbacks to 4 ft. from the sides and rear of a property for new ADU structures.

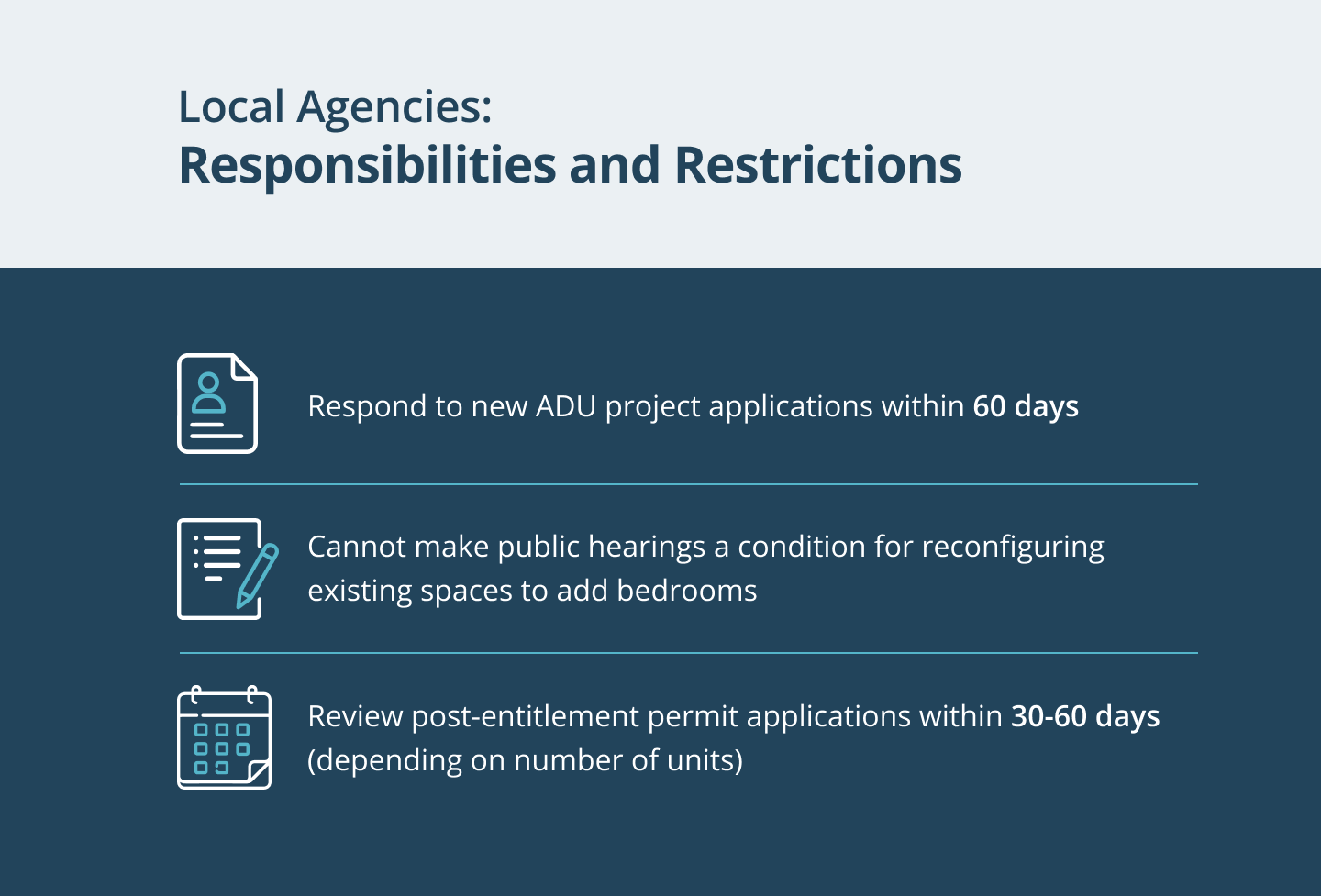

Expediting approvals

Local agencies can no longer use delays as a way to, in effect, deny approval.

After cities receive an application for a new ADU project, the new legislation cuts the approval period in half — from 120 days to 60 days. If cities fail to respond within 60 days, the project is automatically approved.

Another new piece of housing legislation, AB 916, prohibits local agencies from making public hearings a condition for reconfiguring existing spaces to add bedrooms (assuming it’s not more than two bedrooms being added to any single existing space).

While not specific to ADUs, additional California regulations are aimed at solving the housing crisis by reducing timelines for approval. To supplement the Permit Streamlining Act (PSA) and prevent costly delays, AB 2234 gives local agencies 30 days to review completed post-entitlement permit applications for development projects with 25 homes or less and 60 days for projects with more than 25 homes. Failure to comply with this timeline now constitutes a violation of the Housing Accountability Act (HAA), which exposes local agencies to liability for attorney’s fees, mandamus relief, and potential fines.

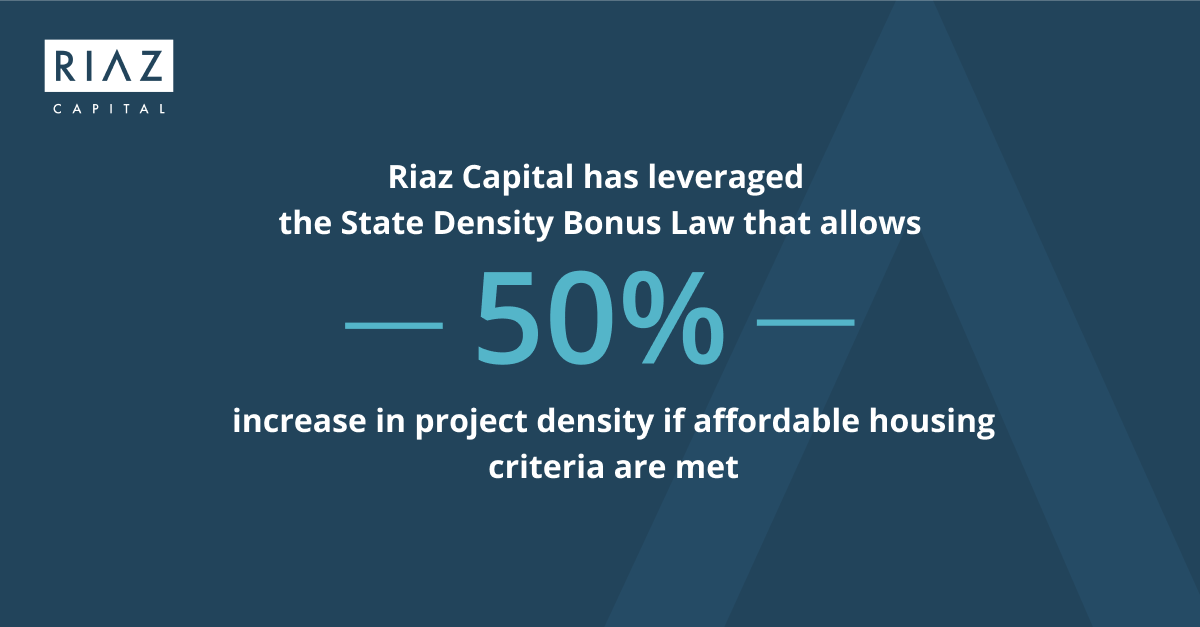

The State Density Bonus Law

The State Density Bonus Law, perhaps the single most effective piece of legislation for reducing California’s housing shortage, allows developers to increase the number of units in a development if they commit to designating a percentage of units as affordable. The percentage of additional units the developer can obtain is contingent on the level of affordability provided. This provision for higher density within a project dramatically lowers per-unit development costs and increases rentable square footage, while making housing more accessible for the budget-constrained urban workforce.

Allowing 50% More Units

Developers statewide are permitted to build 50% more units than would otherwise be allowed on a project if ANY of the following three conditions are met:

- 1. At least 15% of all units are reserved for “very low income.”

- 2. At least 24% are reserved for “low income.”

- 3. At least 44% are reserved for “moderate income.”

There are various parking, height, and setback waivers and concessions available to enable developers to fit the added density within qualifying projects.

The Density Bonus Law also uses a sliding scale, so that projects that don’t qualify for the full 50% increase may still qualify for a smaller increase in density (along with some parking, height, and/or setback waivers and concessions) if they meet other, less stringent conditions, such as 20% low-income student housing in a student housing development. If qualifying projects are within a half mile of a major public transit stop or if they are located in a very low vehicle traffic area, even more waivers and concessions are available.

Parameters Governing Density in Mixed-Use Zones

Calculating Base Density to Determine Applicable Bonuses

This year, the State legislature passed AB 2334 to clarify how to apply bonuses in mixed-use zones where density has been calculated by Floor Area Ratio (FAR) as opposed to the set number of allowable units. Base density (and by extension, any density bonus) will now be determined simply by dwelling units per acre.

If local land use controls don’t provide this standard, then AB 2334 requires that base density be calculated by estimating the realistic development capacity of the site according to “form-based” objective development standards, such as FAR, site coverage, maximum building height and number of stories, building setbacks, and so on.

If local code doesn't specify a dwelling unit per acre standard, applicants can provide their own base density studies according to those same objective standards. If “density” according to a zoning ordinance is inconsistent with “density” according to the general or specific plan, then the applicable standard will be whichever one allows for greater density.

Density Benefits for Commercial Projects

With respect to mixed-use projects, AB 1551 reinstates a law that provided State Density Bonus Law benefits to commercial projects that include affordable housing. To qualify, commercial developers must provide (or partner with a housing developer for) on-site housing in which 30% of the units are low-income or 15% are very low-income. If housing is off-site, it must be located within the city limits, close to public amenities and located within half a mile of a major public transit stop.

If the project qualifies, the commercial development may be granted a wide range of incentives: for example, up to a 20% increase in maximum allowable density in the General Plan, up to a 20% increase in maximum allowable floor area ratio, up to a 20% increase in maximum height requirements, up to a 20% reduction in the minimum parking requirements, use of a limited-application elevator for upper floor accessibility, and an exception to a zoning ordinance or other land use regulation.

Density Benefits for ‘Shared Housing’

With respect to co-living, AB 682 mandates that ‘shared housing’ is also eligible for State Density Bonus Law benefits. Shared housing is defined as a residential or mixed-use structure with 5 or more housing units and 1 or more kitchen/dining areas designed for permanent residence of more than 30 days by its tenants. The only condition for a building of this sort is that it contains 10% low-income units, 5% very low-income, or is a senior housing development. In other words, jurisdictions are now prohibited from requiring a certain minimum unit size or a minimum number of bedrooms for shared housing. This is significant because shared housing often doesn’t meet these requirements because of the small unit sizes.