Riaz Capital’s Strategic Initiatives Boost Occupancy Above Market

April 08, 2024

It is no secret that the Oakland rental market is struggling on both the demand and supply sides: a glut of new deliveries is hitting the market while local crime and inaction from City leaders are causing businesses and citizens alike to pack up and leave town. Many struggling multifamily housing operators are quickly learning that the asset management status quo of the past will simply not work in the current environment.

Having recognized this trend and possible outcome early on, Riaz Capital has put in significant effort over the last two years into developing and implementing strategic company initiatives to boost performance in creative ways and ahead of the competition

Riaz Capital vs. The Market: 90.2% vs. 77.6% Occupancy

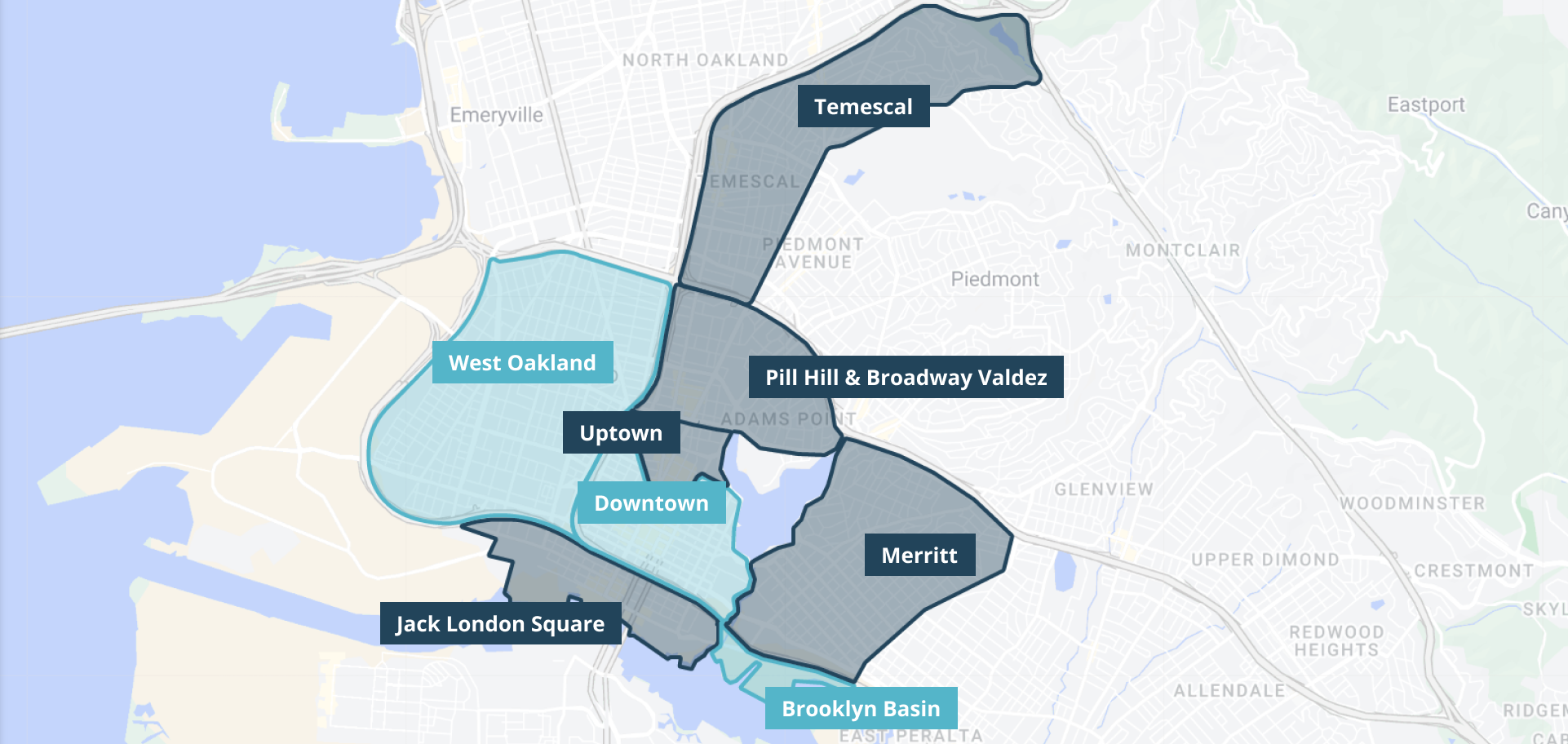

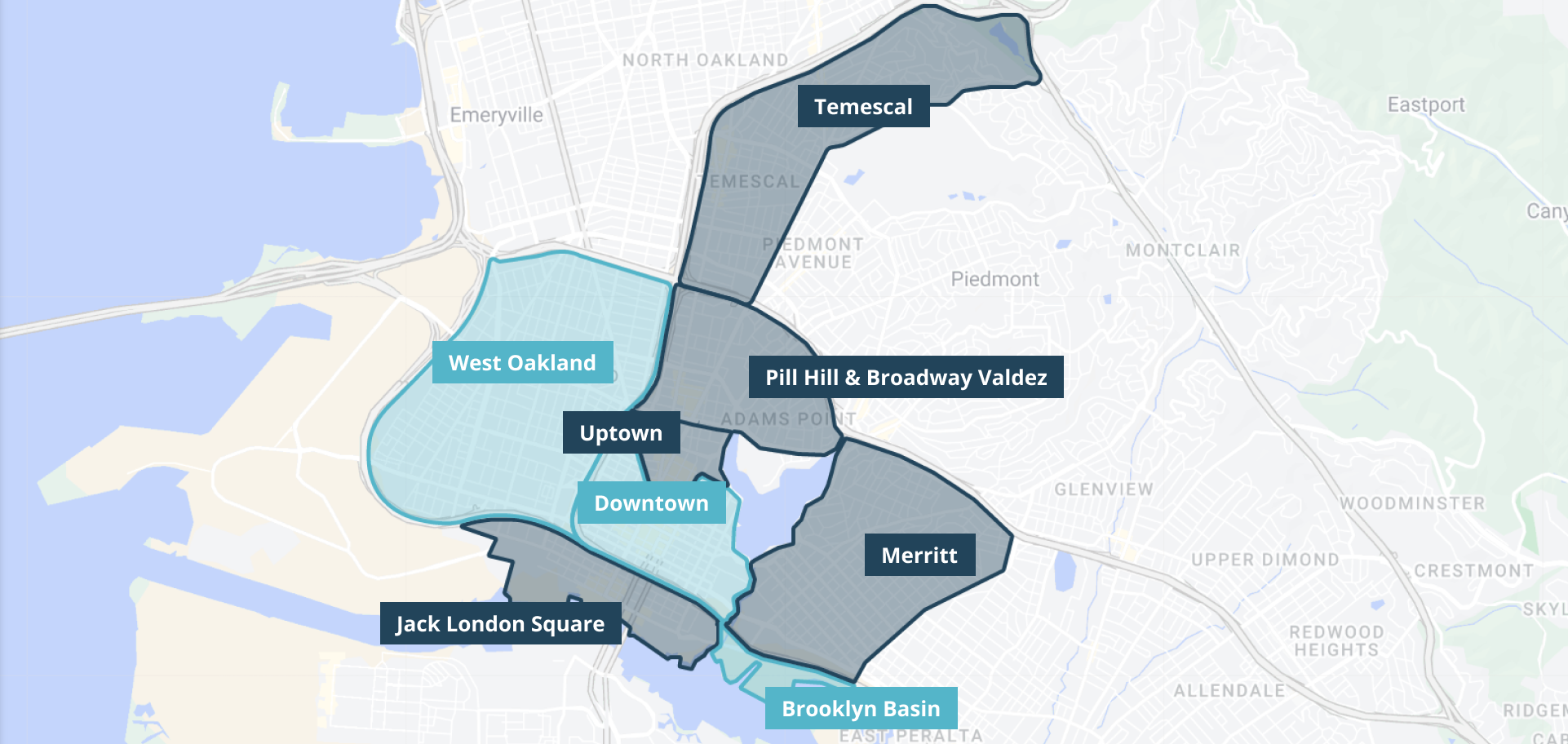

The factors that currently plague the Oakland market are easily visible anecdotally but also demonstrated by the data, as shown in the JLL analysis below.

| Neighborhood Seekers | Employment Seekers | |

|---|---|---|

| Defining Characteristics | Renters who prioritize community amenities and neighborhoods with established identities | Often newer to city, renters prioritize proximity to work or community. |

| Existing Inventory | 6.970 | 3,586 |

| Effective Rent Growth (Y-O-Y) | -5.6% | -2.3% |

| Total Occupancy | 86.6% | 77.6% |

Source: JLL Research, Axiometrics, Figures above reflect December 2023 estimates, Data as of January 2024

The Riaz Capital Artthaus Living Portfolio boasts a 90.2% occupancy on a trailing 6-month basis and largely includes properties located within the "Employment Seekers" areas, which has seen only a 77.6% occupancy rate. This significant outperformance compared to the market is attributable to our creation of a short-term lodging program and community partnership leasing.

Baseline Occupancy - 72.9% Occupancy Segmentation - Trailing 6 Months

The Riaz Capital Artthaus Living Portfolio boasts a 90.2% occupancy on a trailing 6-month basis and largely includes properties located within the "Employment Seekers" areas, which has seen only a 77.6% occupancy rate. This significant outperformance compared to the market is attributable to our creation of a short-term lodging program and community partnership leasing.

Short-Term Lodging - 9.1% Occupancy Segmentation - Trailing 6 Months

In select properties, Riaz Capital offers the availability to book shorter-term rentals (30-90 days) directly through artthaus.com and on sites like Airbnb. This initiative has allowed us to expand our customer base without additional risk, providing a 9.1% lift to the baseline occupancy derived from the core business of long-term leasing activity.

Community Partnerships - 8.2% Occupancy Segmentation - Trailing 6 Months

Riaz Capital forged alliances with Teachers Rooted in Oakland, the International Rescue Committee, Urban Ed Academy, and Oakland Roots to help align the developments with the unique needs of the communities they serve while providing a stable source of new tenants for the buildings. This initiative has provided an 8.2% lift to the baseline occupancy derived from the core business of long-term leasing activity.

| Trailing 6 Months | Q4 2023 | Q1 2024 | ||||

|---|---|---|---|---|---|---|

| Units | Percentage | Units | Percentage | Units | Percentage | |

| Long-Term Leasing | 242 | 72.9% | 240 | 72.3% | 244 | 73.5% |

| Short-Term Loadging | 30 | 9.1% | 29 | 8.9% | 31 | 9.2% |

| Partnership Leases | 27 | 8.2% | 27 | 8.2% | 27 | 8.3% |

| Total | 299 | 90.2% | 297 | 89.3% | 302 | 91.1% |

As the first quarter of 2024 comes to a close, we see that these strategies continue to improve overall performance even beyond the six-month average. The persisting pressures of a softening rental market and high-interest rate environment recently took down The Amelia in Oakland. However, our successful new business lines of short-term lodging and community partnership leasing have been pivotal in ensuring Riaz Capital avoids that fate and have also demonstrated the company’s unwavering ability to adapt and overcome challenges.