We look for deals in attractive markets. These include urban centers with a lack of affordable housing options, an underserved demographic, and contrarian market sentiment. This project is located in Fremont, the fourth most populated city in the Bay Area and the second largest with Alameda County, which has a largely undersupplied housing market.

We look for sites with strong market fundamentals, including access to mass transit, proximity to entertainment and recreational options, large employment and education opportunities, and extra space to increase the property’s density. Fremont’s proximity to Silicon Valley makes it an ideal location for tech workers. The property is also located between two major freeways (I-880 and I-680) and is close to two BART stations.

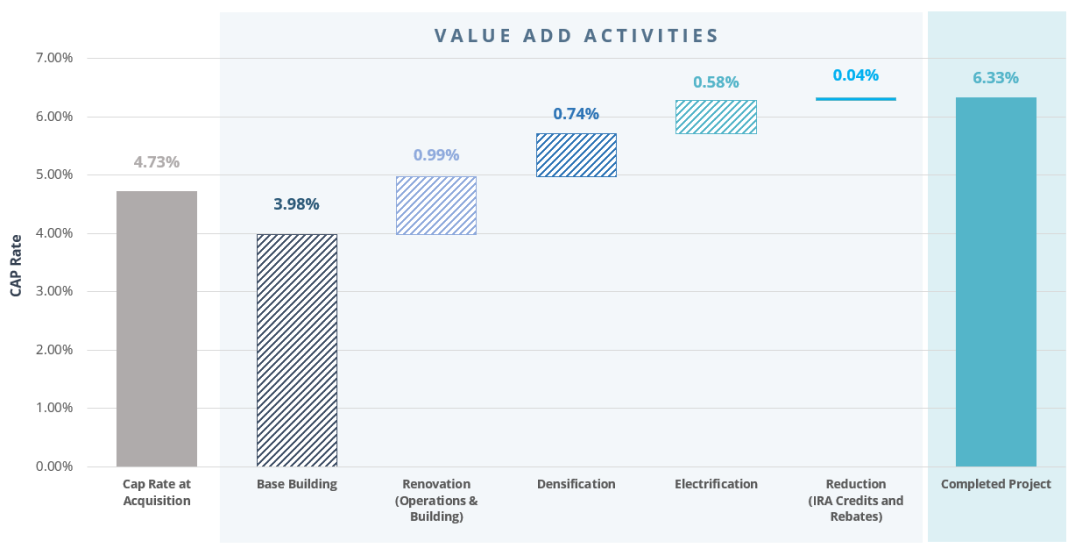

Our first goal upon acquisition is to improve the quality and longevity of the building. On this project, we focused our initial efforts on improving the property’s marketing and leasing functions as well as on making small capital improvements and unit upgrades through the natural turnover cycle.

Consistent with our baseline value-add project, we gave the property a fresh coat of paint and some new finishes to modernize its feel. We installed new, functional amenities including a new fitness center, a dog run area, multiple BBQ areas, and a new bocce court. While these improvements may seem minimal, they went a long way toward improving our residents’ living experience.

We began to make improvements to the property’s units and will continue to upgrade them as the natural turnover process continues.

One of the primary focus areas of our value-add strategy is increasing the unit count, and ultimately, the density of our projects. We achieve this by converting large floor plans into multiple units or by adding Accessory Dwelling Units or ‘ADUs’ where possible. By leveraging State legislation, we are able to build new units on existing properties and subdivide large, inefficient unit layouts to add new studio apartments.

Niles Station is a good example of our ability to convert large units into smaller, more efficient units as well as our ability to add new ADUs. On this project, we took three existing two bedroom townhomes and converted each into duplexes with two individual studio apartments.

Additionally, we were able to convert the existing Victorian home, which was previously used as a single family residence, into three individual studio apartments. Finally, we converted an existing storage area into an ADU studio apartment, bringing the total number of new units to seven. Through these densification activities, we were able to bring the unit count from 93 to 100 units.

As part of the unit improvements, we will be adding new electric systems and energy efficiencies.This includes new electric appliances, upgraded service systems, new wiring, and new insulation. These activities will qualify for new rebate programs outlined in the Inflation Reduction Act, which we anticipate will reduce the overall cost of improvements by up to $14,000 per unit. These rebates also apply to any new units we add to the building. As part of our energy upgrades, we will be adding a new solar power system to offset a portion of the building’s energy consumption. Part of the Inflation Reduction Act provides tax credits for the creation of solar power, which will reduce the installation costs of these systems. Moreover, we will be able to charge the tenants for the power we deliver, creating an additional revenue stream for the property.