ASSET MANAGEMENT

With over $100 million in assets under management, our Asset Management division focuses on mid-market multi-family acquisitions in the East Bay and luxury developments in San Francisco.

Our projects and funds have generated returns that are significantly above market and we are now excited to offer two new fund opportunities in the Riaz Capital Group Value Fund I and an upcoming development opportunity in Oakland.

TRACK RECORD

SAN FRANCISCO LUXURY CONDO BUILDING PROJECT.

THE HIGHEST PRICE PER FOOT FOR A CONDO BUILDING IN SAN FRANCISCO HISTORY

We wanted to create something that had the ease and function of the Four Seasons but was in Pacific Heights. We brought in consultants for everything from acoustics to waterproofing during the construction of the three-unit building in Pacific Heights. Our efforts resulted in a project return of 48.19% IRR and a 2.09x equity multiple.

APARTMENT BUILDING TO STUDENT HOUSING CONVERSION.

THE HIGHEST PRICE PER UNIT FOR A RENOVATED APARTMENT BUILDING WITH OVER 5 UNITS IN THE HISTORY OF BERKELEY

In 2012 we discovered a nine unit vacant building near UC Berkeley that was undervalued due to seismic issues. In addition to a seismic renovation we increased the total square footage of the building prior to sale resulting in a project IRR of 98.7% and a 2.86x equity multiple.

MULTI-FAMILY OAKLAND BUILDING PORTFOLIO

IMPROVED HOUSING STOCK AND CREATED SIGNIFICANT VALUE FOR INVESTORS BY IDENTIFYING UP-AND-COMING OAKLAND NEIGHBORHOODS

Riaz Capital correctly forecast the shift in demographics during the economic downturns of the last decade and acquired properties in a variety of Oakland’s neighborhoods. These investments across 800 units returned above market IRR and equity multiples.

RTS EAST BAY FAMILY FUND I

In 2012, the principals of Riaz Capital and it’s affiliates created a value-add investment vehicle (EBMF Fund I) which raised 7.8M in private equity. Our value add proposition consists of the following steps: (i) identify and acquire underperforming properties (ii) renovate and reposition the properties (iii) improve the management, marketing and leasing of the properties (iv) align the interests of the property management with that of the Partnership; and (v) leverage Riaz Inc. experience and understanding of local rent and tenant regulations to maximize value. Since 2012, the fund has purchased 145 units which if sold today would result in a greater than 25% IRR for the partnership.

INVESTMENT OPPORTUNITIES

RIAZ CAPITAL GROUP VALUE FUND I LP

Riaz Inc. is raising it’s second Value-Add fund, Riaz Capital Group Value Fund I. The Partnership will seek to capitalize and continue on the success of EBMF Fund I, by it’s current value add strategy of investing in cash flowing multifamily properties in San Francisco’s East Bay. RCG believes there is an opportunity to generate attractive risk-adjusted returns through this strategy by acquiring well-occupied properties, implementing RCG’s property renovation and repositioning program, and capitalizing on favorable macro and micro fundamentals.

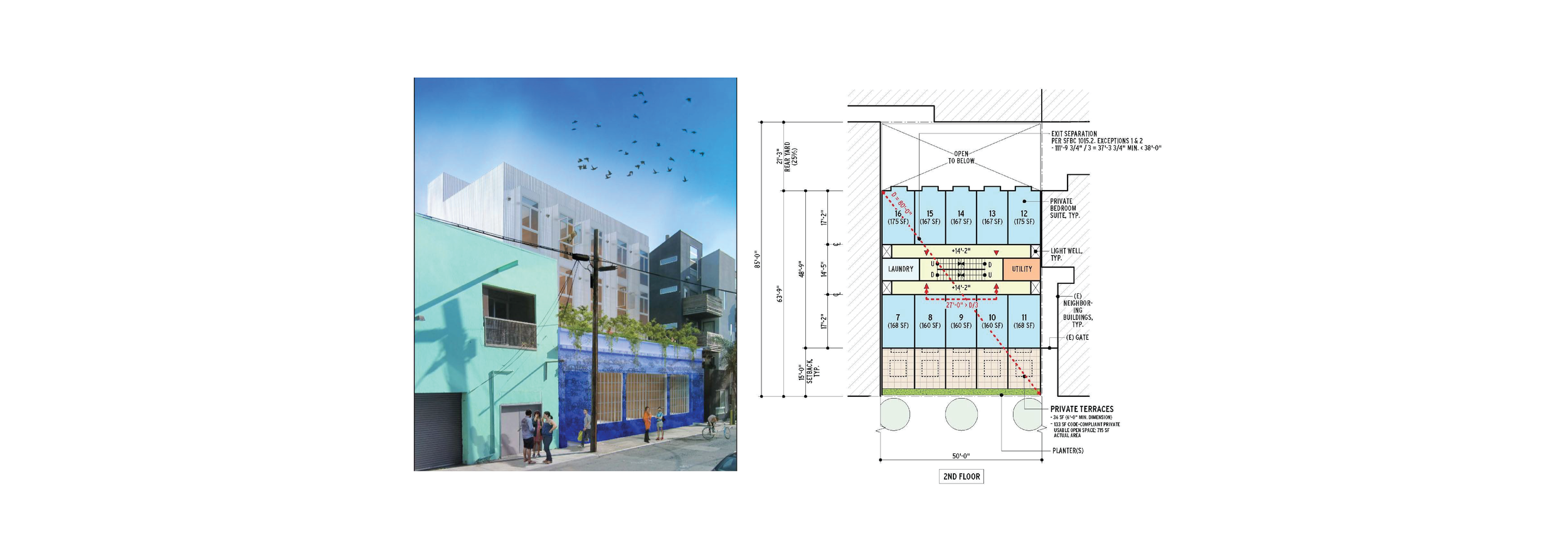

UPCOMING DEVELOPMENT OPPORTUNITY

Riaz Capital is pleased to announce the launch of its next development opportunity. Riaz Capital is raising approximately $11M of equity to acquire and build 209 Multi-family units on a 100,000 square foot parcel in Oakland, California. The LP is structured as a limited partnership that: (a) invests equity in a ‘buy, build and own’ cycle with a 10-year term; (b) yields current income as a function of operating cash flows, plus capital gains at exit.